At the beginning of 2015 I made some predictions for grins. Here's how they played out:

The original post containing the predictions can be found here:

1) Dollar strength continues after a brief pause against all major currencies except the yen. With the Euro decisively breaking the long term support of 1.20.

This indeed was the year of dollar strength with the Euro below 1.10 and the trend may continue well into 2016.

2) Yen strength should result in a bout of carry trade liquidation that is a major negative for risk assets such as emerging market currencies and commodities.

While the dollar was broadly strong against the yen, the Yen was relatively strong against most other majors and 2016 promised to be year of Yen strength. This year saw a massive down move in commodities as expected.

3) Despite slowing growth in most emerging economies, policy makers have their hands tied and spend a whole lot of resources defending their weak currencies unsuccessfully with higher interest rates.

Emerging market currencies saw major take downs ( The Real & Rand being notable examples) across the board and the trend is set to continue in 2016.

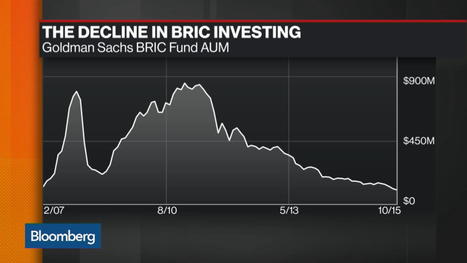

4) This in turn sparks a major exodus of FII money flows out of emerging economies like the BRIC countries which causes their stock markets to significantly under perform despite their terrific performance in 2014 and greedy analysts calls for more.

BRIC stock markets under performed significantly in 2015 except China and more weakness is likely in 2016.

5) Volatility surges in 2015 as the Vix index doubles following a major take down of stock market indices across the globe.

The Vix crossed 50 briefly in August before retreating. A big up move in the Vix is likely in 2016.

6) Risk free assets will be among the safer bets in 2015 as risk appetites significantly wanes with treasury yields continuing to plummet with QE forever still continuing but without the desired outcomes.

Risk free assets outperformed risky assets globally but US long term yields rose as the FED began tightening Monetary policy. Risky free assets will continue to outperform in 2016.

Happy New Year!

TrueCar and Devon Energy were both winners this week after third-quarter results, but FireEye had a much rougher week for investors."

At first, the market seemed so, well, mature. The market didn't tank on Friday, in the face of that strong jobs report and rising odds that the Fed would hike rates. The market's maturity is getting tested on Monday."

A former adviser to Gordon Brown has urged people to stock up on canned goods and bottled water as stock markets around the world slide.

Damian McBride appeared to suggest that the stock market di..."

Jeffrey Kleintop, Charles Schwab's senior vice president and chief global investment strategist, discusses corporate earnings and the outlook for global stocks with Bloomberg's Mike Regan and Betty Liu on "Bloomberg Markets." (Source: Bloomberg)..."

If you want to get rich, the single most..."

This morning on the Tip TV Finance Show Clem Chambers, Founder of ADVFN, joined Nick Batsford to discuss how central banks are influencing the stock market, as"

While the Chinese Yuan devaluation has taken the global markets by storm this week, it certainly is not the first of its kind and pales in comparison to the 50% devaluation in the Yuan in 1994. A very interesting chart from

dailyfx below provides insight into the fluctuations in the Yuan.

It also appears that the #Yuan is yet to catch up with the deteriorating macro economic back drop in China as per the next chart from

dailyfx and the current devaluation may not help matters in the long term.

Regardless the contagion effect on the #BRIC and other emerging economies can't be ignored as the threat of cheap Chinese exports flooding the market place is alive and well in the near term. The mere prospect of this has sent some BRIC currencies and stock markets sharply lower and this is likely to continue in the short term:

Weakness in the Indian #Rupee will most often translate into weakness for the Indian banking space as potential hawkishness forced on the #RBI in defense of the Rupee could hurt bank margins. The Rupee has weakened considerably since Russia raised interest rates to defend the slumping Ruble and more recently with China devaluing the Yuan.

Recent topping action in the bank index could suggest a possible sell off in this space in anticipation of further Rupee weakness and potential hawkishness from the RBI. Just going back to August 2013 banks corrected over 30% when the Rupee fell to over 68 Rupees to the dollar and the RBI embarked on some serious tightening raising the overnight lending rate from 7% to 9%.

Market Insight

-

-

LinkedIn's 'Open To Work' Banner Is 'Biggest Red Flag' When It Comes To

Landing A Job, Says Former Google Recruiter

-

LinkedIn lets job seekers post "open to work" banners on their profiles to

let employers know they are searching for jobs. But, activating it could be

a ...

34 minutes ago

-

Three Stocks: Apple, Rivian, and Live Nation

-

Three Stocks: Apple, Rivian, and Live Nation

Apple Apple (AAPL) shares are bucking today’s market rally, heading lower

by nearly 2%. Shares of the iPhone a...

49 minutes ago

-

The Home Depot, Inc. (NYSE:HD) Shares Purchased by Beverly Hills Private

Wealth LLC

-

Beverly Hills Private Wealth LLC boosted its holdings in The Home Depot,

Inc. (NYSE:HD – Free Report) by 11.5% during the fourth quarter, according

to the ...

1 hour ago

-

Worker Engagement Hits 11-Year Low, Plus How Bilingual Workers Are Saved By

AI

-

Employee engagement has fallen to its lowest point in 11 years, according

to a new Gallup analysis, with Gen Z employees showing the biggest drop.

1 hour ago

-

Tuesday links: buying business with cash

-

Strategy

- Joe Wiggins, "It is important to remember that behavioural finance

would be redundant if it were easy; if it wasn’t hard it wouldn’t be...

3 hours ago

-

Financial Nihilism Is A Symptom Of Society Gone Sick (You Need To Know This

Concept)

-

I am not a financial nihilist and I reject those that advocate for it,

because it goes totally against sound money management principles that use

conservat...

3 hours ago

-

Transcript: Samara Cohen, Blackrock ETF CIO

-

The transcript from this week’s, MiB: Samara Cohen, CIO, Blackrock

ETF & Index Investments, is below. You can stream and download our full

conversa...

7 hours ago

-

The Ultimate Stock Market Showdown: 1 Key Factor to Watch

-

The stock market is facing headwinds as earnings season kicks off. Now, the

Growth factor in Green Zone Power Ratings is so important.

The post The Ultim...

9 hours ago

-

Daily Market Brief

-

Subscriber content. To subscribe to the Daily Market Brief please visit

Market Services on NorthmanTrader.com. The Daily Market Brief is an

in-depth market...

9 hours ago

-

Debt Rattle April 16 2024

-

Charles Sprague Pearce The Arab jeweler c1882 • “I Can’t Go To My Son’s

Graduation”: NY Judge Threatens Trump With Arrest (ZH) • Trump Trial in

Manhatt...

11 hours ago

-

Who is Binaifer Nowrojee? The Incoming President of Open Society Foundations

-

Binaifer Nowrojee has been appointed as the president of George Soros’ Open

Society Foundations (OSF) as Mark Malloch-Brown plans to officially step

down i...

15 hours ago

-

This Is Why The Price Of Gasoline Could Soon Double…

-

Can you imagine paying seven dollars for a gallon of gasoline? It could

soon happen, because it appears that Israel is about to strike Iran, and

that is...

21 hours ago

-

Financial Forecast 2025-2032: Please Don't Be Naive

-

*Rather than attempt to evade Caesar's reach, a better strategy might be to

'go gray': blend in, appear average. *

*Let's start by stipulating that I don'...

1 day ago

-

Rates related to monetary policy : The fed funds rate stays between the

discount rate and the reverse repo rate

-

Different interest rates are involved in the monetary policy process: The

federal funds rate (FFR) gets most of the news headlines, but deeper

reporting re...

1 day ago

-

Top Reasons to Exit S&P Short Positions Soon | Allen Reminick

-

The S&P market has been behaving as expected. It looks as if April 15 (Mon)

or so could be a low followed by a bounce for a few days until April 18

(Thu) f...

1 day ago

-

S&P 500 PE Ratio

-

*Current S&P 500 PE Ratio:* 27.47

12:00 AM EDT, Mon Apr 15

1 day ago

-

Shifting Wind

-

Weekly report covering Gold, Equities, Crude, Dollar. A look at trade

opportunities and covering the model portfolio.

The post Shifting Wind appeared fir...

2 days ago

-

SoundHound AI’s Market Potential: Opportunities and Challenges Ahead

-

SoundHound AI, Inc. (SOUN) is a leading global company specializing in

conversational intelligence. The company provides advanced voice Artificial

Intellig...

3 days ago

-

Doctor Copper Has A Message On Inflation

-

[image: copper leading indication cpi inflation]

One trite Wall Street saying is that copper is the only metal with a PhD in

economics. This is because ...

5 days ago

-

-

Mastering Crypto Swing Trading: Bitcoin’s Bullish Breakout and Top Altcoins

to Watch

-

Embark on a journey to master the art of crypto swing trading with Deron

Wagner, founder of Morpheus Trading Group. In this illuminating blog, Deron

unra...

1 week ago

-

Get More Out of Your Trades: Dukascopy Bank SA Cuts Withdrawal Fees

-

Dukascopy Bank SA would like to announce the reduction of withdrawal

transfer fees on trading products, as follows:

*Old fees* *New reduced fees*

3.5 EUR...

2 weeks ago

-

Weekend Update - Trendline rejection (3/8/24)

-

SPX was rejected by the blue trendline Friday. The trendline had been

sucessfully tested four times and held since November, until now. SPX has

unable ...

5 weeks ago

-

Catastrophic Risk: Investing and Business Implications

-

In the context of valuing companies, and sharing those valuations, I do

get suggestions from readers on companies that I should value next. While I

d...

2 months ago

-

Hello world!

-

Welcome to WordPress. This is your first post. Edit or delete it, then

start writing!

2 months ago

-

Teaching Johns Hopkins A Privilege Lesson

-

by Not Sure01/12/24Johns Hopkins Hospital Chief Diversity Officer Sherita

Hill Golden sent a letter out essentially implying that all people who

don’t look...

3 months ago

-

Mungerisms: Timeless Wisdom from Charlie Munger on Life and Business

-

"Mungerisms" are succinct expressions of wisdom and insights coined by

Charlie Munger, the Vice Chairman of Berkshire Hathaway and Warren

Buffett's longtim...

4 months ago

-

If You Find Deer or Elk Antlers on the Ground, Leave Them There, Say Some

States

-

Even though elk do shed their antlers naturally, collecting them brings up

a number of ethical issues.

6 months ago

-

It’s Crunch Time for The Daily Doom and Doom Time for The Great Recession

Blog

-

The Great Recession Blog is officially done for good, and it remains to be

seen if all my writing continues on TheDailyDoom.com. If my writing on

economi...

9 months ago

-

Innovative Industrial Properties Stock a Great Way to Play Pot Sector

-

*IIPR Stock Represents a Long-Term Opportunity*

Marijuana stocks briefly attracted investors' attention following the 2022

mid-term elections, when Maryl...

1 year ago

-

2008 analogue

-

The 2008 analogue tape looks very interesting from where we stand.

Let's anchor it to the next two Fed meetings -- since that's all that

matters -- and i...

1 year ago

-

Back to trade with Bar Replay

-

It is often said that one should not be sad about the past, but sometimes

it can be nice to return to it. Who would like to buy Tesla for $1 and

experience...

1 year ago

-

After This Holiday Rally, You Better Know When To Walk Away

-

This week’s investor insight will make you think twice about the current

stock and bond rally as we head into the end of the year. We get a lot of

questi...

1 year ago

-

How Africa Can Escape Chronic Food Insecurity Amid Climate Change

-

The toll of extreme weather events on crops underscores the region’s

challenges and need for policies to save lives and protect livelihoods.

1 year ago

-

12 Bear Market Rules To Live By – Survive & Thrive In The Next Bear Market

-

12 Bear Market Rules To Live By – Survive & Thrive In The Next Bear Market

[image: Bear Market Rules Survival Guide]

I grew up in the 1970s-1980s when th...

1 year ago

-

Growth Companies – Getting What You Want

-

What do the growth companies in your field have in common? How are they

doing so well and what can you learn from them? Growth companies usually

make a pro...

1 year ago

-

-

Blog Post Title

-

What goes into a blog post? Helpful, industry-specific content that: 1)

gives readers a useful takeaway, and 2) shows you’re an industry expert.

Use your c...

2 years ago

-

Foot Locker Crushed Q2 Earnings Expectations Sending Stock Higher

-

Plus, AstraZeneca said its antibody therapy reduced the risk of developing

COVID-19 symptoms by 77%, The Topps Co’s SPAC merger is off, and Elon Musk

annou...

2 years ago

-

Elliott Wave Stock Market Update - July 10th

-

The market has continued its rally to higher highs and it doesn't seem like

it wants to stop. We now have a new ATH at 4371 which are NASDAQ levels

s...

2 years ago

-

The Psychology of QE is Far More Important Than the Amount of It

-

Let's discuss what QE really does vs the psychology of QE.

2 years ago

-

Hello world!

-

Welcome to WordPress. This is your first post. Edit or delete it, then

start writing!

3 years ago

-

Trading: Opportunities Are Dispersed

-

Opportunities are dispersed. You might have an... *READ THE REST OF THE

ARTICLE ON THE NEW WEBSITE: JIM ROGERS TALKS MARKETS *

*Jim Rogers is a legendary i...

3 years ago

-

Market Signals for the US stock market S and P 500 Index and Indian Stock

Market Nifty Index for the Week beginning November 09

-

Indicator Weekly Level / Change Implication for S & P 500 Implication for

Nifty* S & P 500 3509, 7.32% Bullish Bullish Nifty 12264, 5.34% Neutral **

Bullis...

3 years ago

-

-

Fully Automated Trend Trading w/ Stocks Or Options

-

There’s a lot of research to support the usage of trend indicators as

simple risk reduction elements that can be layered onto an existing

strategy. Howev...

3 years ago

-

2020 Top Investment Picks – Q3 Update

-

At the beginning of the year, I put together a list of Top Investment Picks

for 2020 from the investment community and track them on this website. This

is ...

3 years ago

-

Upside-Down Markets: Profits, Inflation and Equity Valuation in Fiscal

Policy Regimes

-

I just published a new long-form piece through OSAM entitled “Upside-Down

Markets: Profits, Inflation and Equity Valuation in Fiscal Policy Regimes.”

In th...

3 years ago

-

The last of 12326

-

February 22nd 2012.....

First post...

https://permabeardoomster.blogspot.com/2012/02/can-anyone-fly-plane.html

--

This post will be the last under the o...

3 years ago

-

-

6/7 to 10/7, 2020 Nifty & Bank Nifty, Bharat Forge, IBhasgFin & RIL.

Weekly futures Pr...

3 years ago

-

Ultramarathoner Runs Over 200 Miles in Backyard, Wins Golden Toilet Paper

Roll

-

Strange times indeed. In the land “BC,” before coronavirus, people ran long

distances in foot races, and toilet paper wasn’t coveted. Things have

changed. ...

4 years ago

-

One Year Later

-

A year ago today I lost my father and my best friend, everyone here lost

their mentor and a friend. Dad and I spent the last 7 years of his life

living tog...

4 years ago

-

-

Advanced Micro Devices (AMD) Retreating Towards Key Support Around

$25.60-$27

-

AMD has failed to clear the

2018 high around $34.20. It is retreating, and has broken an

August/September sup...

4 years ago

-

Advanced Search is Now on Stocktwits

-

Advanced Search Is Now on Stocktwits

Come rain or shine, the Stocktwits community shares over 200,000 messages

per day. That includes charts, news, trade i...

4 years ago

-

Nightly Algo Report – December 6, 2018

-

To access this post, you must purchase Premium Plan or Premium Plan -

Annual.

The post Nightly Algo Report – December 6, 2018 appeared first on

Elliottwa...

5 years ago

-

Don’t be Fooled by the Pullback in the Dollar Because….

-

Don’t be fooled by the pullback in the U.S. dollar today because the

greenback could still strengthen further before the end of the year. Nearly

all of the...

5 years ago

-

A look at the bull market ahead

-

My latest missive on the near-term stock market outlook can be seen at

Financial Sense web site. You can see it by clicking on the following link:

https:/...

6 years ago

-

Weekly Videos

-

This week’s video will be posted on the new home for Short Takes. If all

goes well, it will appear sometime between 6:00 and 8:00 pm ET.

6 years ago

-

Gold Miners near a buy zone

-

Gold cleared a several month long consolidation a few weeks ago as it

cleared $1300, and has since been consolidating as it drifts back to […]

The post G...

6 years ago

-

Current Account Deficits and Safe Assets

-

The International Monetary Fund has issued its External Sector Report for

2017, and among its key findings: “Global current account imbalances were

broadly...

6 years ago

-

Kafka For The Twenty First Century

-

I've been spending a slightly frustrating day trying to update my payment

details at google. To log in to my admin console I need to log in using my

G Sui...

7 years ago

-

Gold Unleashed by Fed

-

Gold's next major upleg was likely unleashed by a very-dovish FOMC this

week, which now has its hands tied on hiking rates or being hawkish due to

the US e...

7 years ago

-

August 24th Blogger Sentiment Poll

-

There are more bulls than bears in this week's poll. Blogger Sentiment Poll

Participants: 24/7 Wall St (N) Carl Futia (+) Dash of Insight (+) Elliot

Wave L...

14 years ago

My Favorite Books

- The Intelligent Investor

- Liars Poker

- One up on Wall Street

- Beating the Street

- Remniscience of a stock operator

India Market Insight

-

SP 500 falls third day in a row, down 0.11% today; GIFT Nifty flat

-

[image: SP 500 falls third day in a row, down 0.11% today; GIFT Nifty flat]

DIIs net purchased Rs 2,040.38 crore while the FIIs/FPIs continued to net

sell ...

1 hour ago

-

Intraday Trading Levels for BANK NIFTY Options: April 16, 2024 – Weekly

Expiry

-

Below are the BANK Nifty Weekly Options Trading Levels for April 16,

2024 Trading . Options are for April 16 BANK NIFTY Weekly Expiry. Please

see the...

16 hours ago

-

Rupee falls 29 paise to close at 82.68 against US dollar

-

During the day, the rupee touched a high of 82.45 and a low of 82.68

against the greenback. On Friday, the rupee had settled at 82.39 against

the dollar.

10 months ago

-

-

ES Hourly cloud and 4 Hour chart

-

- ES Hour moving towards the hourly cloud which may act as resistance.

- 4 Hour chart shows a possible bullish candle which may give new high's

...

2 years ago

-

JUST NIFTY BLOG 10-01-2020

-

Bulk Deals FII DII Stats Date # of Deals Total Volume (In Millions)

01-01-1970 0 0.00 Click here to see all Bulk Deals Date Category Buy Amount

(Rs. Cror...

4 years ago

-

Vist Note on Federal Bank

-

We recently met the senior management of Federal Bank which is one of the

old private sector banks with a distribution network of 1252 branches (48%

Kerala...

6 years ago

-

Nifty Bulls bounces ferociously holding 9930,EOD Analysis

-

FII's bought 4.8 K contract of Index Future worth 262 cores ,9.7 K Long

contract were added by FII's and 4.8 K Short contracts were added by FII's.

Net Ope...

6 years ago

-

Midcap & Smallcap Index Corrects, Lets Come Back To Fundamentals Again

-

Midcap Index had made a high of 18511 on 16th May 2017, fell almost 7% and

is currently trading at 17230. Smallcap Index made all time high of 7679 on

11th...

6 years ago

-

Market outlook for 30/10/2016

-

*Nifty closed up 22.75 points (0.26%) at 8638.00* while Future closed at

8667.40, premium of 29.40 points.

*Bank Nifty closed up 41.35 points (0.21%) at 19...

7 years ago

-

Option Open Interest for 28-10-2016

-

Inference The index opened flat to positive and after making an initial low

around 8581 saw some short covering to close at 8638.00, gain of 22.75

points. ...

7 years ago

-

Market Review for 23rd August 2016

-

*Nifty (8629)* we said ‘technically trend is still intact but there exists

selling pressure near 8746 and support around 8600 zones’ the Nifty

unfolded as...

7 years ago

-

ITC To Resume Cigarette Manufacturing

-

ITC manufactures a range of cigarette brands, including India Kings,

Classic, Gold Flake, Navy Cut, Capstan, Bristol, Flake, Silk Cut, which are

manufactur...

8 years ago

-

My Asset Allocation Strategy (Indian Market)

Cash - 40%

Bonds - 20%

Fixed deposit - 20%

Gold - 5%

Stocks - 10% ( Majority of this in dividend funds)

Other Asset Classes - 5%

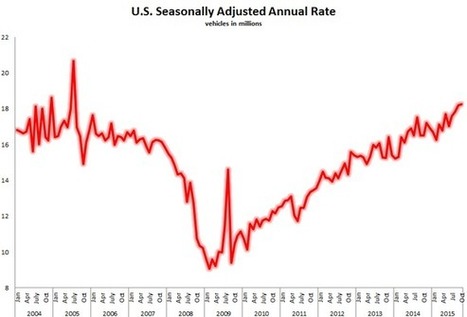

My belief is that stocks are relatively overvalued compared to bonds and attractive buying opportunities can come along after 1-2 years. In a deflationary scenario no asset class does well other than U.S bonds, the U.S dollar and the Japanese yen, so better to be safe than sorry with high quality government bonds and fixed deposits. Cash is the king always. Of course this varies with the person's age.